Cheap Ways to Make Your Home Energy Efficient

/In my last blog, I talked about ways to save money on a solar installation. This week, I want to talk about several ways to save money on new, energy-efficient appliances and inexpensive ways to reduce your energy consumption.

Energy Efficient Home Improvement Credit

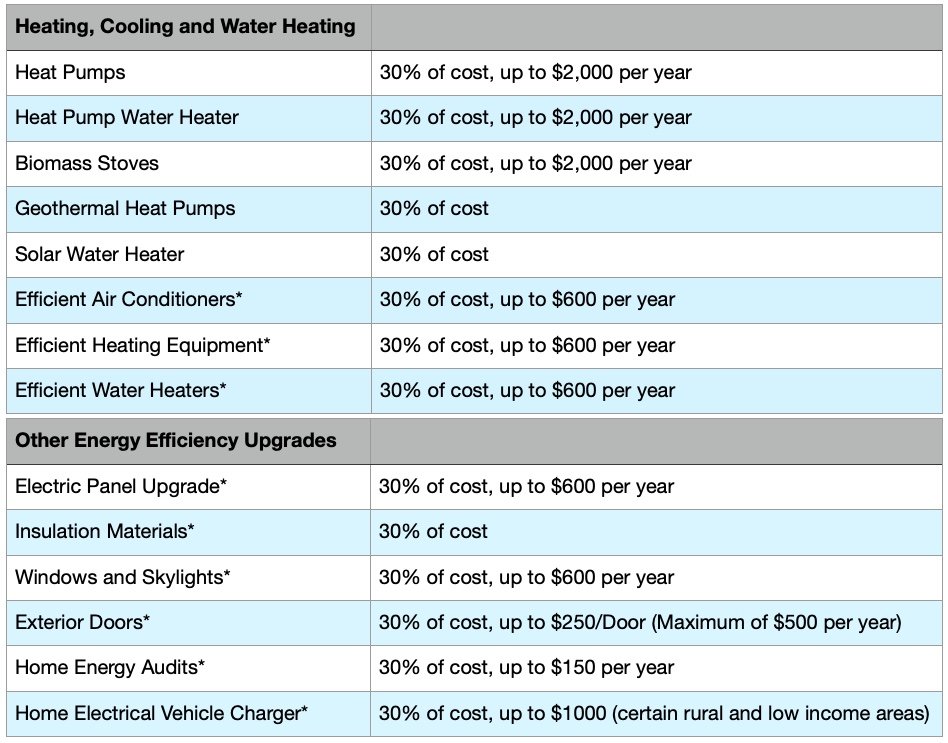

These are federal tax credits for the things you do to your house to make it more energy efficient. For example, if you upgrade your doors or windows to Energy Star requirements, improve your home's insulation or replace an old water heater or furnace with a more efficient heat pump model, you may qualify for a 30% tax credit. From the IRS:

There are, however, some limits on the amount of tax credit that can be claimed each year, as well as a couple of caveats to be aware of.

The maximum tax credit for all the starred items above is $1,200, and the total combined tax credit that can be claimed per year for all the items in the tables above is $3,200. You can, though, claim the maximum annual credit every year that you make eligible improvements.

These are tax credits, not rebates or tax deductions, i.e. a credit that can be applied to the taxes you owe. If your taxable income is low enough that you don’t pay any taxes, a tax credit does you no good.

While other tax credits can be carried forward into future tax years, the Energy Efficient Home Improvement Credit must be claimed in year that the improvements are made. If you don't have enough tax liability to claim all the credit in the year that the improvements were made, the unused amount of the credit cannot be used in later years.

For more on the subject, here is a link to the IRS page that explains it in more detail.

State and Local Incentives

Many states and counties also offer incentives and tax credits for installing solar and other renewable energy sources or for making your home more energy efficient. For example, Nevada Energy, our electrical utility company in southern Nevada, offers free energy-efficient appliances like dryers and stoves to customers with incomes of 80% or less of the median income (80% of $83,900, or $67,210 in Las Vegas). (You can find the median income for your address here. NV Energy also offers up to a 50% rebate on home battery banks with certain metering plans.

Here is a list of the incentives for each state. (BTW, I did discover that some of the listed information for Nevada was out-of-date and no longer applicable, so you will want to verify the data shown for your state).

Wait - There's More!

Finally, as part of the 2022 Inflation Reduction Act, Congress passed the High-Efficiency Electric Home Rebate Act or HEEHRA (not the catchiest acronym). This is a ten-year rebate program and will cover 100% (up to $14,000) of the cost for low and moderate-income homeowners to replace their old electric resistance and gas appliances with new energy-efficient ones. It includes:

Up to an $8,000 instant rebate on an electric heat pump

Up to a $1,750 instant rebate on a heat pump water heater

Up to an $840 instant rebate on a condensing electric dryer

Up to an $840 instant rebate on an electric range

In addition, qualifying households are eligible for instant rebates up to $4,000 for breaker box revisions and $2,500 for electrical wiring upgrades to accommodate the new electric appliances.

To qualify as a low or moderate income household, annual earnings must be less than 80% of the area’s median income level. For example, a household in the Denver area (where median income is $125,500) could earn up to $100,400 to qualify for the 100% HEEHRA rebates as a low or moderate income family. In addition, households earning between 80% and 150% of their area’s median income will still qualify for 50% of the HEEHRA electrification project rebates. In case you missed it above, you can find the median income for your area here.

The U.S. Department of Energy will make funds available to each state, and the individual states will be responsible for setting up and administering the program. As of today, it is expected that the HEEHRA rebates will begin to be available in some areas by the 3rd quarter of 2024, and in most areas by the beginning of 2025.

In most locales, the rebates will be instantaneous at the point-of-sale. That means, for example, that if you qualify for the program, you could go to a Best Buy, Lowes, or other appliance store, buy a new energy- efficient range that costs no more than $840, load it onto a dolly and walk out with it at no cost.

If you can wait until 2025 to upgrade your appliances, it will be worth it.

See you next time when we start designing our solar installation…