Cape Town Check-Out & Claiming the VAT

/We checked out with Customs, Immigration and Port Authority today for departure tomorrow morning. The Royal Cape YC is located within a Customs-controlled, gated industrial area. We walked about a mile down heavily-traveled, slightly dangerous Duncan Road to the three offices we needed to visit for checkout. Sometimes there's a sidewalk, sometimes not. The fences are lined with concertina razor wire and the views are not particularly appealing. The acrid smell of diesel mingled with fish meal and industrial pollution make this an unpleasant walk.

In order to proceed this far, we had to have clearance from the yacht club that confirmed we'd paid our mooring fees and we had to complete a float plan (which they call a flight plan for some reason) describing the boat, safety equipment aboard, crew, our next port of call, etc. Paperwork rules! We needed to call in at Customs, Immigration and finally Port Authority, in that order, to secure proper departure clearance.

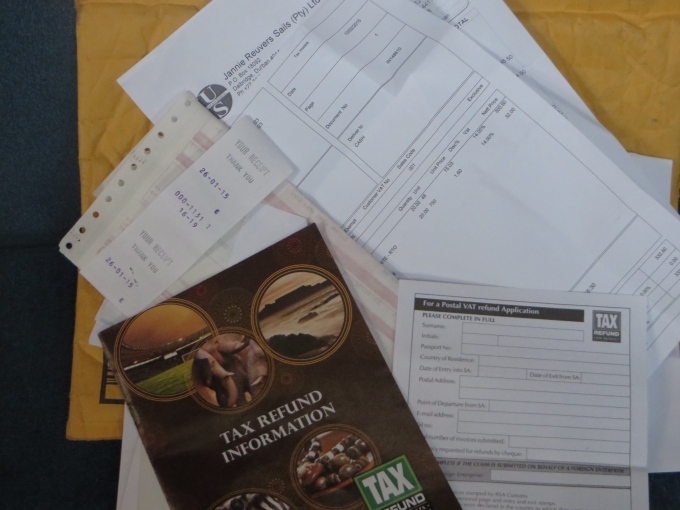

Because we're parsimonious sailors, we've saved all of our eligible VAT receipts in hopes of claiming a refund. The VAT, value-added tax, is a hefty 14% nationwide tax that's assessed on everything … products, as well as services. If you go to the dentist, you pay the VAT. If you buy corn flakes, you pay the VAT. It's a fact of life in many countries including South Africa. Compared to the usual 6-9% state sales taxes in the USA, this is definitely a bit more substantial and it's levied on everything. Visitors can claim the VAT they've paid on specific purchases and receive a refund when they leave the country.

There are strict rules regarding a VAT refund, in fact a whole booklet of rules in several languages, which I studied carefully. VAT cannot be claimed on services or items consumed in South Africa. Eligible purchases must have been made within three months of departure and they must be taken out of the country. Each receipt must be marked as a Tax Invoice with specific information included and must be greater than R250 (~$25US). We'd been pretty fastidious about keeping all receipts. Actually, I just pinned up a big envelope inside a locker and we stuffed all the receipts inside. I just sorted through them yesterday to see what we could claim. It's the Customs officer who completes the form and verifies the receipts.The total refund ended up being a whopping R9431 … definitely worth the effort. Customs told us we could expect a check in US$ to arrive in 4-6 weeks. Hopefully, it'll all work out. That equates to quite a few dinners out or boat parts down the road.

Next stop was Immigration. The officer was cordial. We filled out departure forms and our passports were stamped in a jiffy. The final stop was Port Authority where, after review of our passports and Customs forms, we were issued the necessary clearance paperwork to leave South Africa. Phew!

So we're cleared out and ready to go. We've said our goodbyes. The sails are back on. We've topped up the water tanks and overnight we'll charge every electronic instrument we can think of while we still have power. South Africa has been wonderful and exasperating at the same time. As always, we're a bit sad to go, but happy to be on our way.

Follow us into the Atlantic as we head north. You know we enjoy your company and you never know where we'll all end up.